The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

by John C. BogleThe Little Book of Common Sense Investing is a book that aims to change the way readers view investing. It explains the importance of diversification, the impact of investment costs, and the risks of relying on a fund’s past performance. It introduces the traditional index fund (TIF), which eliminates the risk of picking individual stocks, the risk of emphasizing certain market sectors, and the risk of manager selection. The TIF is designed to be held for a lifetime and is broadly diversified, holding all (or almost all) of its share of the $26 trillion capitalization of the U.S. stock market. The book also explains the power of compounding investment returns and the danger of compounding investment costs. It also explains that beating the stock market is a zero-sum game and that investors as a group have been served only about three-quarters of the market pie. It encourages readers to minimize their trading in stocks and to minimize the share of the returns earned by our corporations that is consumed by Wall Street, and maximize the share of returns that is delivered to Main Street.

Investing in Index Funds: A Sensible Way to Reap Rewards

The Gotrocks family, a wealthy family who owned 100% of every stock in the United States, experienced slower growth in their wealth when some of the family members were persuaded by Helpers to buy and sell shares of different companies. This resulted in capital gains taxes being paid, further diminishing the family's total wealth.

Warren Buffett's advice is that investors should avoid trying to beat the market, as this is a "loser's game". Jack R. Meyer and Burton G. Malkiel both agree that index-fund buyers are likely to obtain better results than the typical fund manager due to low expenses and minimal effort.

Successful investing is about owning businesses and reaping the rewards provided by the dividends and earnings growth of corporations. Investing in index funds is a sensible and cost-effective way to do this, as it helps to keep costs low and maximize returns.

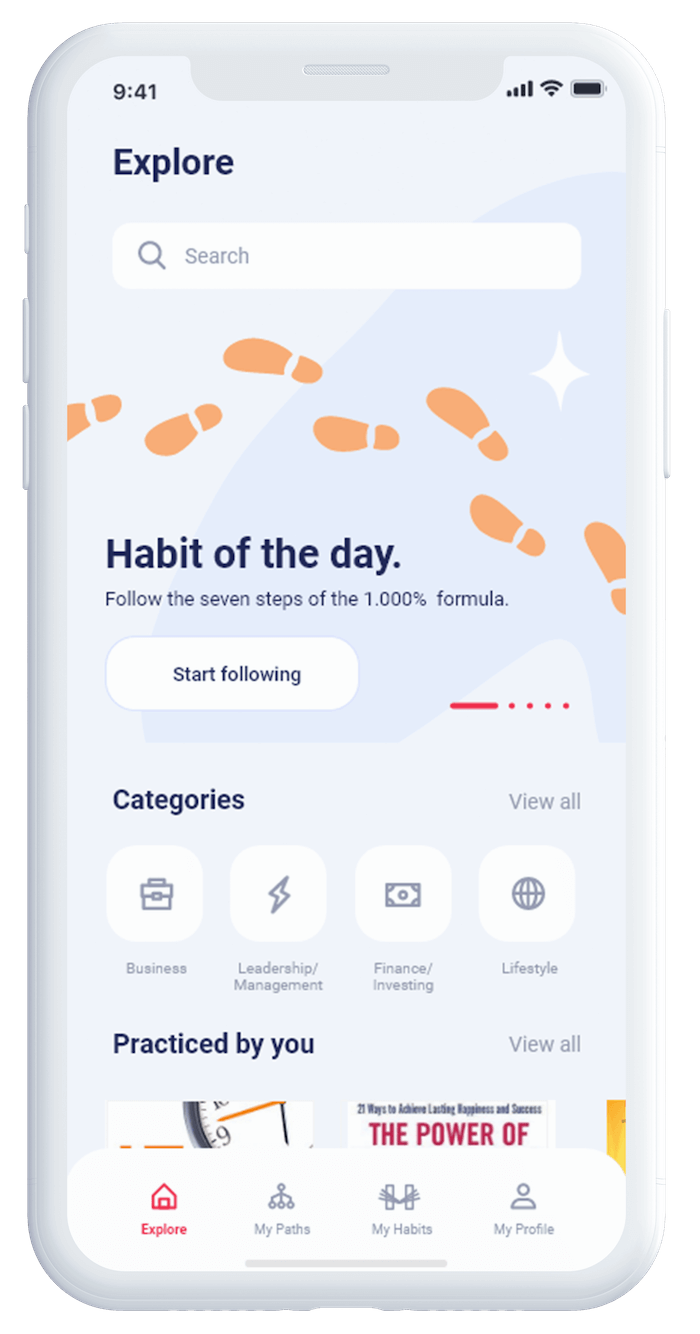

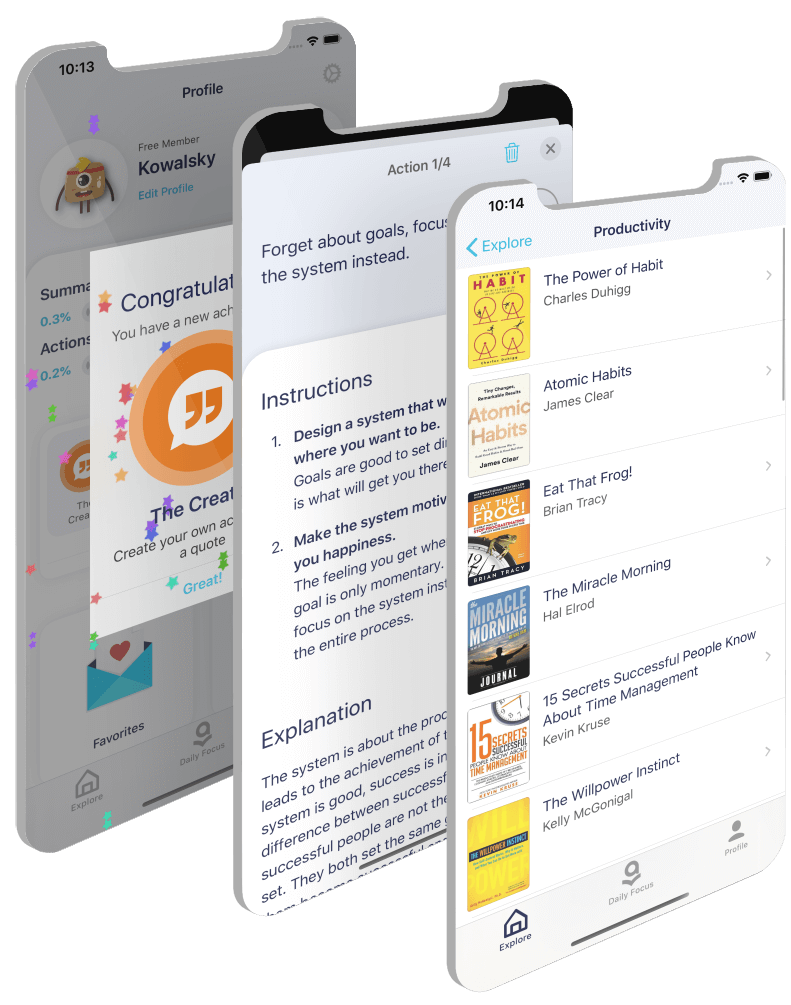

Actions to take

Don’t just read. Act.