MONEY Master the Game: 7 Simple Steps to Financial Freedom

by Anthony RobbinsIn Money - Master the Game, the author presents ideas garnered from interviewing 50 of the most brilliant, influential players in the world of money, including self-made billionaires, Nobel laureates, and famous financial titans. He uncovers the core secrets to their investment success and outlines the seven simple steps to achieving financial security, independence, and freedom you can apply even to the smallest amount of money. The book offers a blueprint for setting and achieving our financial goals and challenges us to break free from whatever limiting behaviors might be holding us back from true abundance.

What Does Money Mean to You?

“If we get underneath what you’re really after, it’s not money at all. What you’re really after is what you think money is going to give you.”

Money can’t change who we are. All it does is magnify our true nature. If you’re mean and selfish, you become more mean and selfish. If you’re grateful and loving, you have more to appreciate and give.

Money is simply a vehicle for trying to meet our needs, not only financial ones. There are six basic needs that make us tick. They drive all human behavior and are the force behind the things we do for money.

The first four are the needs for comfort or certainty, uncertainty or variety, significance, and love and connection. They are personality needs, and we all find ways to meet them, whether by working harder, coming up with big problems, or creating stories to rationalize them. The last two are the needs for personal growth and contribution. These are rare spiritual needs, and not everyone meets them. But when they do, they are most fulfilled.

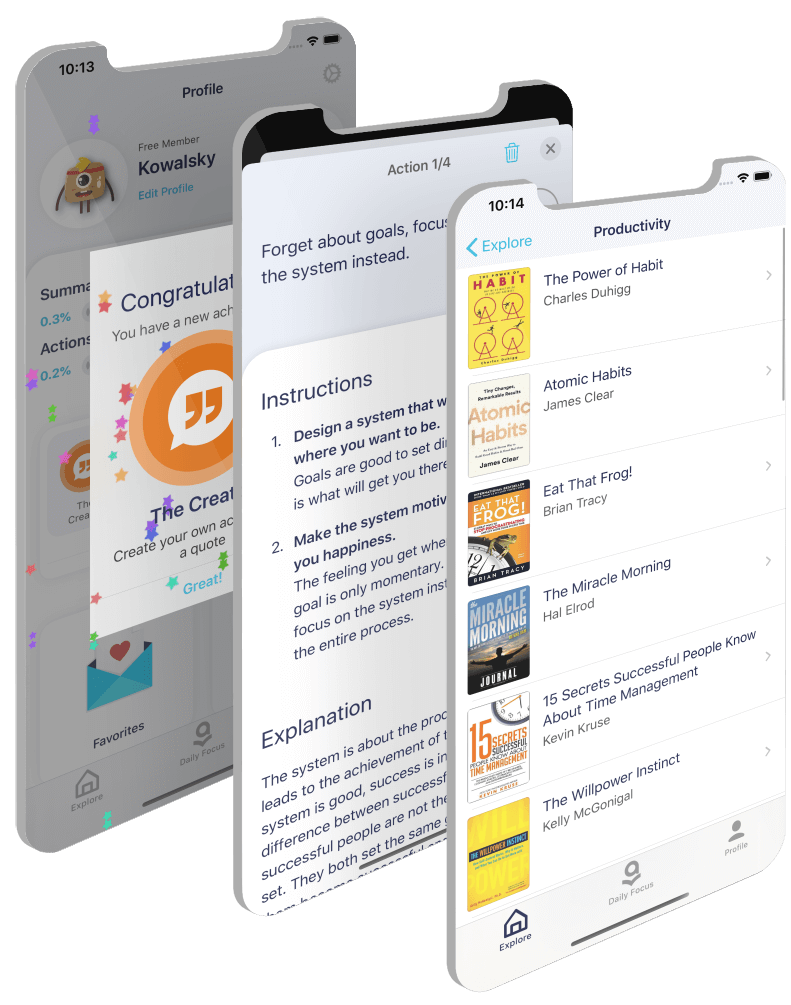

Actions to take

What You Don’t Know Can Hurt You

“If there’s one common denominator of successful insiders, it’s that they don’t speculate with their hard-earned savings; they strategize.”

Giving up a disproportionate amount of your potential returns on investment to fees is one of the pitfalls you must avoid if you plan on winning the money game.

The core concept of successful investing is simple: grow your savings to a point where the interest from your investments will generate enough income to support your lifestyle without having to work. There are two phases of such investing: the accumulation phase, in which you’re socking away money for growth, and the ‘decumulation,’ during which you’re withdrawing income.

There’ll be many hurdles, obstacles, and even lies that’ll prevent you from getting to this point. Your task is to be vigilant and break the chains that may keep you from attaining financial freedom.

Actions to take

Making the Money Game Winnable

“If you get down to the facts, an extraordinary lifestyle probably costs less than you think it does.”

Like most people, you probably have a “magic number” in your head — an amount of money representing financial freedom to you. And you’re probably https://www.mentorist.app/manager/67/#also intimidated by that number because you lack the certainty that you can achieve it. Certainty is the first human need that influences our behaviors and actions. Without it, we default to either doing nothing or procrastinating.

Interestingly, there’s no one magic number for financial freedom. There are only levels of financial dreams that will set you free, and this starts with understanding what you truly need. These levels are: financial security, financial vitality, financial independence, financial freedom, and absolute financial freedom. Each of them grows in size incrementally, and the numbers required to reach them differ.

For some people, financial security alone is already life-changing and gives them enormous freedom. For others, financial vitality would be a blessing, and independence would put them over the moon.

To figure out what level of financial dream you’re ready to achieve, ask yourself what your lifestyle would look like if you had that amount of money — your magic number. Then list all the things and experiences you’d like to do and see how much they would actually cost. By the time you’re done adding them up, you’ll be surprised at how much less money you need to fuel your dream lifestyle actually is, and your certainty of achieving it will be boosted!

Actions to take

The Ultimate Bucket List

“Anybody can become wealthy; asset allocation is how you stay wealthy.”

Asset allocation is the most important investment decision of your lifetime, more important than any single investment you’ll make in stocks, bonds, real estate, or anything else. It’s the one key skill that can set you apart from 99% of all investors.

Think of it as taking chunks of your money and putting them into two separate investment buckets with different levels of risk and reward. The first bucket is a safe environment for your money — your security bucket. It’s not going to grow very fast there but it is always available to you whenever you need it. The second is much riskier. You have to be prepared to lose everything you put in there, but with an opportunity for much quicker growth.

How much goes into each bucket depends on how much time you have to grow your investments and how much risk you’re willing to take. But always remember that you’re not diversifying merely to protect yourself. You want to enhance your results — to find the ideal blend of investments that’ll make you thrive, not just survive.

Actions to take

Upside Without the Downside

“Unconventional wisdom is the only way you can succeed.”

Every investment has an ideal environment in which it flourishes. There’s a season for everything. Stocks perform well during inflation. Higher prices mean that companies have the opportunity to make more money, and those rising revenues mean growth in stock prices. Bonds, on the other hand, do better during seasons of deflation, as their prices typically rise when interest rates fall.

Overall, there are only four things that move the prices of assets: inflation, deflation, rising economic growth, and economic decline. These are the environments or economic seasons that ultimately affect whether the markets go up or down. Except, unlike nature, there’s no predetermined order in which the seasons will arrive.

You should therefore have 25% of your risk in each of these four categories. Four such portfolios, each with an equal amount of risk, will mean you wouldn’t have exposure to any particular environment. By using this investment strategy, you can know —not hope —that you’re protected and that your investments are sheltered and will do well in any season that comes your way.

Actions to take

The Billionaire’s Playbook

“What unites them is the ultimate truth that life is more than what you have. It’s really about what you have to give.”

There are many ways to succeed financially and become wealthy in the world we live in today. Although many financial legends out there have their own distinct ways of winning, they share at least four common obsessions about the market.

First, they’re obsessed with making sure they don’t lose money. Even the world’s greatest hedge fund managers, who you think would be comfortable taking huge risks, are actually laser-focused on protecting their downside.

Second, they love to uncover investments where they can risk a little and make a lot. They pick up the best bargains when the markets are down, and everyone’s desperate to sell.

Third, they protect themselves. They anticipate failure by diversifying because, in the end, all great investors have to make decisions with limited information. Lastly, they’re never done learning, earning, growing, and giving. No matter how well they’ve done or continue to do, they never lose their hunger — the force that unleashes human genius. Their labor is their love.

Actions to take

The Future is Brighter Than You Think

“Anybody can deal with a tough today if he or she feels certain that tomorrow has greater promise.”

We’re living in one of the most extraordinary times on earth. We’ve seen the lifespan of humans in the last 100 years go from 31 to 67 years old — more than doubling! At the same time, the average per capita income, adjusted for inflation, of every person on the planet has tripled. Most Americans used to spend 43% of each day working for food. Now, because of advances in agriculture and distribution, that number has become 7%.

There are breakthroughs occurring today and more in the coming years that will revolutionize the quality of your life and the lives of everyone on earth. This tide of technology will offer an opportunity for all boats to rise. This means that even if you start building wealth later in life, you’ll likely still have a great quality of life in the future for even less money than you might think.

This is good news, and this should encourage you to live a life filled with optimism, purpose, passion, and fulfillment. Enjoy whatever you have today, and use your financial resources to create some happiness for yourself!

Actions to take

Don’t just read. Act.